I left New Brunswick for Montreal last week. I was welcomed by an apartment that needed a deep clean after spending several months away and the weather was terrific. Montreal is as fun as always. Here, spring is well-advanced and the colors are truly magnificent.

Party with the Portugueses! :-)

I have been quiet here on my blog for the past several weeks, but that's because I have been very busy decluttering the stuff I had in New Brunswick. I have been living between Montreal and somewhere in New Brunswick for several years. Actually, I have been living between New Brunswick and other places my whole life. New Brunswick has always been my safe place where I would leave behind my most precious possessions: my books, my academic notes, papers, and more papers (of all sorts). I had about 5-6 big heavy plastic bins, as well as a suitcase packed with papers which was also extremely heavy, not to mention all the other things displayed behind closed drawers and in my very large wardrobe, and not to forget, my bed drawers... Many places to carefully hide away some stuff. I did a big declutter, which left me with only a few things including my books and a few binders which I eventually want to bring all with me to Montreal. I should be able to do so next time I go back home.

It was a big task to go through, but I am glad I did. My old folks are talking about selling the house. I didn't want my stuff to be in the way, all of those heavy things. If they eventually move away, I will only have their things to take care of, and not mine, which will make the moving process a lot easier for them as well as for me, if it has to happen. Something of that nature will eventually happen.

While spending a lot of my time decluttering in the past few weeks, I haven't spent much time watching my stocks, but I notice a few things that are worth talking about. Recently, many bank stocks increased their dividend distribution. I just couldn't believe it! Currently, my dividend income coming from my non-registered and TFSA portfolios is at an annual $10,600, which is not far away from the equivalent of $900 a month. If I include the dividend income earned inside my RRSP portfolio, that amount hits $12,700, which is really not bad at all.

Today, the TSX closed again below the 20,000-point mark, at 19,739.70. It looks like we are slowly entering something like a recession phase or somewhat of a correction, which is worrisome, even if it's not fun to see my wonderful stocks trading lower. It's a good time to save whatever you can so that later on you can invest smartly in quality stocks trading at bargain prices. I think the TSX can go lower. I am not investing at this time. My non-registered portfolio closed today's session at $134,542.67, my TFSA portfolio at $131,464.46, my RRSP portfolio - stocks-only - at $65,561.37, and my US portfolio at $5,443.16 US. One interesting fact is that my non-registered portfolio is almost the same value as my TFSA one.

These days, one stock that I am totally obsessed with is Boyd Group Services Inc. (BYD), which I hold in my TFSA portfolio. In my TFSA portfolio, Boyd Group Services Inc. (BYD) is one of my major holdings. Originally, my investment in BYD exceeded $5,000. Back in the day, Boyd Group Services Inc. (BYD) used to be - if I am not mistaken - a Derek Foster stock. I usually have a good memory of where I pick my stocks from, so I think I am not wrong when I say that BYD used to be a Derek Foster stock. One thing I am almost sure of is that Derek Foster no longer holds any BYD stocks in his portfolio. So that got me worried, and that's the main reason why I have been closely watching BYD.

A stock like Boyd Group Services Inc. (BYD) is totally my vibe. I really like to hold a stock that is not trendy, that is not popular, and that I am basically the only Canadian blogger to write about. Investing in high-quality, super mysterious stocks that I seem to be the only one to know exist on the TSX is my very own personal obsession. Over the years, Stockopedia is a platform that I have used that definitely helped me in that field. An example of a low-profile stock that I found using Stockopedia - among others - is Park Lawn Corporation (PLC). When it comes to BYD, I invested in that stock back in June 2016.

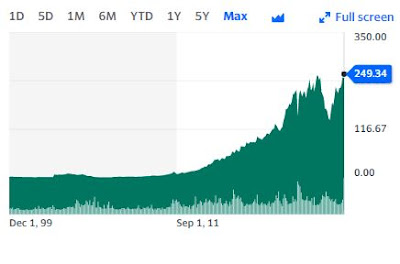

Another reason why I like Boyd Group Services Inc. (BYD) so much is because of its sector - which I consider to be an industrial stock. My sector is the industrial sector. I love stocks that are industrial; it's my vibe, it's what I like, and it's my favorite sector. Boyd Group Services Inc. (BYD)'s overall stock is very impressive. I don't know much about finance, but I know - at least - how to read a chart. And a chart like this - which is the "overall" chart of my precious BYD - screams to me: INVEST!For the past year, the chart of Boyd Group Services Inc. (BYD) has been impressive:

While looking at charts, it's important that you check different variations and not only the overall chart, so you can get a picture of how things are going for that stock. You can look at the past year, the past 5 years, the past 3 years, etc. Another reason why I have been actively checking my BYD stocks, even while I was extra busy decluttering my precious things or shit, is the reason for its price. Currently, BYD stocks exceed $249, which is a lot of money for a single stock. And I somewhat feel that when a stock is at an expensive price like that, it makes it much more volatile, but I guess it's not exactly true. True or not, one thing is for sure, my position in BYD is super great because I am exceeding +15% in profit.

I know BYD is super expensive, but I think it is worth the investment, even if it's only for a few shares. In light of my current success with Boyd Group Services Inc. (BYD), I don't think we'll be facing a recession. We could hit the recession status, but I don't think we'll be facing anything major. I really hope so.

While checking my portfolio, something I notice is my good results with Goodfellow Inc. (GDL), on which I am experiencing a +17% gain. GDL could be a good option to consider if you are afraid of BYD. Another stock that I am very proud of is Vitreous Glass Inc. (VCI), another mysterious stock. That one came from me, resulting from my searches on Stockopedia a little while back.

I think we are in for more posts in the days to come. I like to watch my stocks and write about them, and now I have more time to do so. We have a lot of catching up to do!