Sunday, June 18, 2023

Navigating Debt and Expenses: A Journey Towards Financial Freedom

Wednesday, June 7, 2023

The Story of Dollarama's Strawberry Jam

Wednesday, May 31, 2023

All the Reasons Why I Love My Boyd Group Services Inc. (BYD) Stocks in My TFSA and Other Financial Stories

Party with the Portugueses! :-)

I have been quiet here on my blog for the past several weeks, but that's because I have been very busy decluttering the stuff I had in New Brunswick. I have been living between Montreal and somewhere in New Brunswick for several years. Actually, I have been living between New Brunswick and other places my whole life. New Brunswick has always been my safe place where I would leave behind my most precious possessions: my books, my academic notes, papers, and more papers (of all sorts). I had about 5-6 big heavy plastic bins, as well as a suitcase packed with papers which was also extremely heavy, not to mention all the other things displayed behind closed drawers and in my very large wardrobe, and not to forget, my bed drawers... Many places to carefully hide away some stuff. I did a big declutter, which left me with only a few things including my books and a few binders which I eventually want to bring all with me to Montreal. I should be able to do so next time I go back home.

It was a big task to go through, but I am glad I did. My old folks are talking about selling the house. I didn't want my stuff to be in the way, all of those heavy things. If they eventually move away, I will only have their things to take care of, and not mine, which will make the moving process a lot easier for them as well as for me, if it has to happen. Something of that nature will eventually happen.

While spending a lot of my time decluttering in the past few weeks, I haven't spent much time watching my stocks, but I notice a few things that are worth talking about. Recently, many bank stocks increased their dividend distribution. I just couldn't believe it! Currently, my dividend income coming from my non-registered and TFSA portfolios is at an annual $10,600, which is not far away from the equivalent of $900 a month. If I include the dividend income earned inside my RRSP portfolio, that amount hits $12,700, which is really not bad at all.

Today, the TSX closed again below the 20,000-point mark, at 19,739.70. It looks like we are slowly entering something like a recession phase or somewhat of a correction, which is worrisome, even if it's not fun to see my wonderful stocks trading lower. It's a good time to save whatever you can so that later on you can invest smartly in quality stocks trading at bargain prices. I think the TSX can go lower. I am not investing at this time. My non-registered portfolio closed today's session at $134,542.67, my TFSA portfolio at $131,464.46, my RRSP portfolio - stocks-only - at $65,561.37, and my US portfolio at $5,443.16 US. One interesting fact is that my non-registered portfolio is almost the same value as my TFSA one.

These days, one stock that I am totally obsessed with is Boyd Group Services Inc. (BYD), which I hold in my TFSA portfolio. In my TFSA portfolio, Boyd Group Services Inc. (BYD) is one of my major holdings. Originally, my investment in BYD exceeded $5,000. Back in the day, Boyd Group Services Inc. (BYD) used to be - if I am not mistaken - a Derek Foster stock. I usually have a good memory of where I pick my stocks from, so I think I am not wrong when I say that BYD used to be a Derek Foster stock. One thing I am almost sure of is that Derek Foster no longer holds any BYD stocks in his portfolio. So that got me worried, and that's the main reason why I have been closely watching BYD.

A stock like Boyd Group Services Inc. (BYD) is totally my vibe. I really like to hold a stock that is not trendy, that is not popular, and that I am basically the only Canadian blogger to write about. Investing in high-quality, super mysterious stocks that I seem to be the only one to know exist on the TSX is my very own personal obsession. Over the years, Stockopedia is a platform that I have used that definitely helped me in that field. An example of a low-profile stock that I found using Stockopedia - among others - is Park Lawn Corporation (PLC). When it comes to BYD, I invested in that stock back in June 2016.

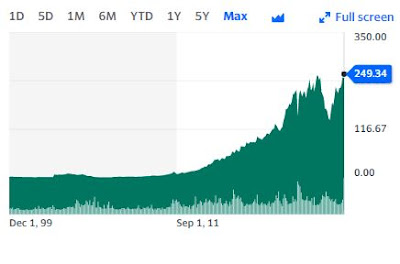

Another reason why I like Boyd Group Services Inc. (BYD) so much is because of its sector - which I consider to be an industrial stock. My sector is the industrial sector. I love stocks that are industrial; it's my vibe, it's what I like, and it's my favorite sector. Boyd Group Services Inc. (BYD)'s overall stock is very impressive. I don't know much about finance, but I know - at least - how to read a chart. And a chart like this - which is the "overall" chart of my precious BYD - screams to me: INVEST!For the past year, the chart of Boyd Group Services Inc. (BYD) has been impressive:

Saturday, May 6, 2023

My investment portfolio on date of May 6, 2023

Cold cash: $19,185.52

Stocks and Units investment portfolio $CAN

Others: $1,159.90

NBI Income Fund: $1,256.36

My debt situation on date of May 6, 2023

Margin Account Debt: $46,237.17 at 8%

Annual Interest: $3,698.97

As of May 6, 2023

For a complete update on my debt situation, please click on the label "Debt Situation" located in the right column of this blog.

Friday, April 21, 2023

Historic of my Total assets and Net worth values on date of April 21, 2023

2023

Total in assets: $393,444.59/Net worth $346,786.01: January 6, 2023

2022

November 8, 2021

Total in assets: $364,072.52/Net worth: $315,407.64: July 26, 2021

Total in assets: $358,867.59/Net worth: $311,858.22: June 15, 2021

Total in assets: $354,774.64/Net worth: $307,559.30: June 10, 2021

Total in assets: $348,042.77/Net worth: $300,799.45 - FIRST TIME I EVER REACHED 300k in net worth, on May 26, 2021

Total in assets: $346,583.88/Net worth: $298,486.93: May 20, 2021

Total in assets: $349,651.45/Net worth: $298,435.31: May 7, 2021

Total in assets: $347,002.53/Net worth: $297,614.64: April 16, 2021

Total in assets: $338,188.16/Net worth: $287,914.75: March 11, 2021

Total in assets: $333,970.92/Net worth: $283,675.99: March 9, 2021

Total in assets: $328,881.12/Net worth: $279,611.57: February 10, 2021

Total in assets: $326,670.02/Net worth: $278,758.37: February 8, 2021

Total in assets: $324,891.52/Net worth: $276,979.87: February 4, 2021

Total in assets: $322,236.52/Net worth: $274,318.36: February 3, 2021

Total in assets: $327,639.01/Net worth: $274,298.23: January 19, 2021

Total in assets: $316,192.85/Net worth: $268,180.14: January 7, 2021

Total in assets: $313,003.95/Net worth: $264,915.22: January 6, 2021

Total in assets: $310,587.36/Net worth: $262,498.63: January 5, 2021

2020

Total in assets: $310,392.38/Net worth: $259,661.24: December 31, 2020

Total in assets: $307,812.05/Net worth: $259,070.79: December 24, 2020

Total in assets: $306,444.25/Net worth: $258,948.73: December 4, 2020

Total in assets: $304,701.39/Net worth: $257,331.58: November 27, 2020

Total in assets: $300,956.84/Net worth: $253,587.03: November 24, 2020

Total in assets: $298,903.01/Net worth: $251,533.20: November 23, 2020

Total in assets: $296,643.60/Net worth: $249,158.71: November 20, 2020

Total in assets: $294,514.87/Net worth: $247,145.87: November 11, 2020

Total in assets: $291,172.40/Net worth: $243,802.59: November 10, 2020

Total in assets: $287 803.13/Net worth: $240 433.32: November 9, 2020

Total in assets: $277,872.92/Net worth: $226,678.26: August 5, 2020

Total in assets: $276,627.27/Net worth: $227,745.47: June 6, 2020

Total in assets: $263,304.63/Net worth: $211,395.63: April 29, 2020

Total in assets: $241 461,13/Net worth: $194 558,29: March 13, 2020

Total in assets: $282,640.61/Net worth: $235,284.72: February 21, 2020

Total in assets: $304,955.72/Net worth: $257,187.44: February 12, 2020

Total in assets: $296,200.07/Net worth: $250,595: January 16, 2020

Total in assets: $292,715.58/Net worth: $244,970.41: January 9, 2020

2019

Total in assets: $288,237.52/Net worth: $239,582.44: December 31, 2019

Total in assets: $278,823.27/Net worth: $230,902.04: September 17, 2019

Total in assets: $271,896.19/Net worth: 226,137.05: June 24, 2019

Total in assets: $269 950.21/Net worth: $222 942.87: April 5, 2019

Total in assets: $251 634.94/Net worth: $206 278.84: January 18, 2019

Total in assets: $238 656.07/Net worth: $191 009.83: January 4, 2019

2018

Total in assets: $270 679.86/Net worth: $204 306.57: November 16, 2018

Total in assets: $332 750.88/Net worth: $232 609.15: August 3, 2018

Total in assets: $331 413.83/Net worth: $232 280.40: June 20, 2018

Total in assets: $326 085.75/Net worth: $226 801.92: June 3, 2018

Total in assets: $322 479.23/Net worth: $222 850.15: May 4, 2018

Total in assets: $319 644.86/Net worth: $217 246.23: March 16, 2018

2017

Total in assets: $318 544.64/Net worth: $221 989.65: December 29, 2017

Net worth on the date of November 17, 2017: $211 430.89

Net worth on the date of October 27, 2017: $212 633.39

Net worth on the date of September 29, 2017: $206 352.49

Net worth on the date of April 24, 2017: $204 277.66

Net worth on the date of March 31, 2017: $200 325.69

Net worth on the date of March 29, 2017: $198 299.73

Net worth on the date of March 18, 2017: $193 969.21

2016

Net worth on the date of December 30, 2016: $184 074.35

Net worth after debt on the date of January 1, 2014:

$101 172.99 (yes, finally, IN NET WORTH!).

On the date of February 16, 2011, the TMX hit 14 000+ points, and I exceeded the 150k in assets! (Not net worth yet).

On September 9, 2010, I reached $100,000 in assets! (not in net worth yet).

On the date of August 5, 2009, I reached my investment goal: I reached $50 000 worth of assets! (NOW, net worth).

On the date of December 5, 2009, I had exceeded $60 000 in assets! (not in net worth yet).

My investment portfolio on date of April 21, 2023

Cold cash: $17,651.41

Stocks and Units investment portfolio $CAN

RSP investment portfolio:

Others: $1,159.90

NBI Income Fund: $1,254.02